mailchi.mp

The American Heritage Museum’s Vietnam War Gallery will be expanding with two significant new additions over the coming year: a Soviet SA-2 Guideline surface-to-air missile (SAM) on long-term loan ...“America was built on courage, on imagination and an unbeatable determination to do the job at hand.”

-Harry S. Truman, 33rd President of the United States

The story of America is one of resilience, courage, and a steadfast willingness to step forward in times of great need. Time and again, when called upon, ordinary citizens have shown extraordinary generosity—of their time, talents, and resources. In the same spirit that our forefathers once rallied for their country, we ask you to join us in preserving their stories and sacrifices by supporting the American Heritage Museum during this season of giving.

From the Revolutionary War, when farmers and tradesmen answered the call to arms, to World War II, when millions of Americans left the safety of their homes to fight tyranny on a global scale, the American spirit has always been one of voluntary service. The same impulse moved first responders and ordinary citizens to act heroically during the tragic events of 9/11, rushing toward danger to protect their fellow citizens. These defining moments remind us of the power of America’s collective will and selflessness.

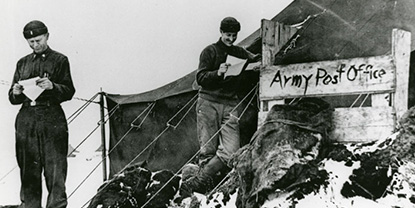

A living tribute

Today, we stand on the shoulders of these giants, charged with ensuring that their stories continue to inspire future generations. The American Heritage Museum is not just a repository of artifacts; it is a living tribute to the sacrifices made for freedom. From the tanks that rolled across Europe during D-Day to the planes that patrolled our skies in defense of liberty, our museum brings history to life.

But just as our nation’s freedom was secured by the hands of many, so too is the future of this museum. Without support by any national, state, or local government or any branch of the armed forces, we rely on the voluntary generosity of donors like you to keep our exhibits vibrant, our collections growing, and educational programs thriving. In this way, you are continuing the legacy of those who stepped forward when their country needed them.

On the eve of an historic milestone

This is especially important as we enter the 80th Anniversary of the end of World War II and the 250th Anniversary of the beginning of the American Revolutionary War. Programs to honor and celebrate these historically significant events are part of our core mission and will require more support from donors like you to accomplish.

Your contribution to our Annual Fund helps ensure that we preserve these stories of valor, expand our educational outreach, and inspire the next generation to understand and cherish the freedoms that are so dearly won.

Will you step forward this year and support this mission with a gift to our Annual Fund?

By making a tax-deductible donation today, you become an essential part of keeping the American spirit alive within these museum walls, where history is not just remembered, but felt, honored, and passed on.

Just as our forefathers stepped up in the face of adversity, your generosity today allows us to honor the past and safeguard our future. Thank you for standing with us and ensuring that these vital stories of courage and sacrifice are never be forgotten.

Thank you for stepping forward and standing with us.